Table Of Content

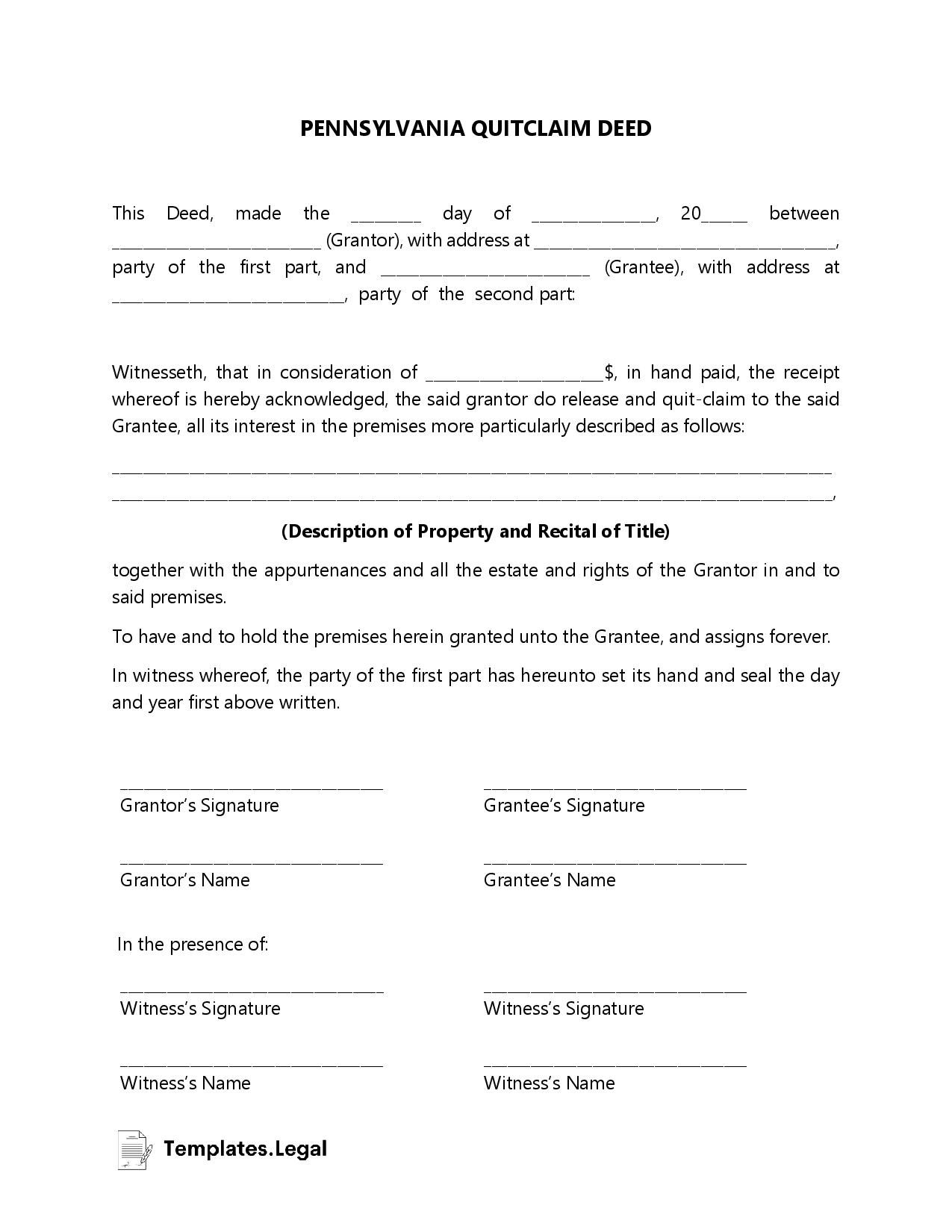

In a quitclaim deed, the grantor “quits” any claim to the property and simply passes it to the grantee. It only transfers whatever interest the grantor has in the property and does not guarantee the grantor’s ownership. A property title is the legal right of ownership for the piece of real estate you own. The biggest difference between title and deed is that title is a legal concept, whereas a deed is a physical legal document. When it comes to buying a house, there’s a lot of terminology to know.

Deed: Legal Definition, Types, Requirements, vs. Title

Kevin Rector is a legal affairs reporter for the Los Angeles Times covering the California Supreme Court, the 9th Circuit Court of Appeals and other legal trends and issues. He started with The Times in 2020 and previously covered the Los Angeles Police Department for the paper. Before that, Rector worked at the Baltimore Sun for eight years, where he was a police and investigative reporter and part of a team that won the 2020 Pulitzer Prize in local reporting. The 9th Circuit has already allowed for reasonable restrictions on when, where and how homeless people can sleep or build protective structures, the critics said. And San Francisco already have such policies in place — and actively enforce them. The couple also found they were eligible for a Federal Housing Administration loan.

Rocket Mortgage

A title search is a comprehensive evaluation of records, sources, and documents to identify all available and relevant title information about a particular property. The intent of the title search is to determine if anyone may have a claim on the home besides the owner. This type of deed is often used when the grantor isn’t sure if the title holds any defects, or they don’t want to have any liability. We often see quitclaim deeds used when there are multiple owners to a property, or when a grantor is gifting their property interest to another party.

Quitclaim Deeds

Area property deed transfers, April 25 - GazetteNET

Area property deed transfers, April 25.

Posted: Wed, 24 Apr 2024 16:03:29 GMT [source]

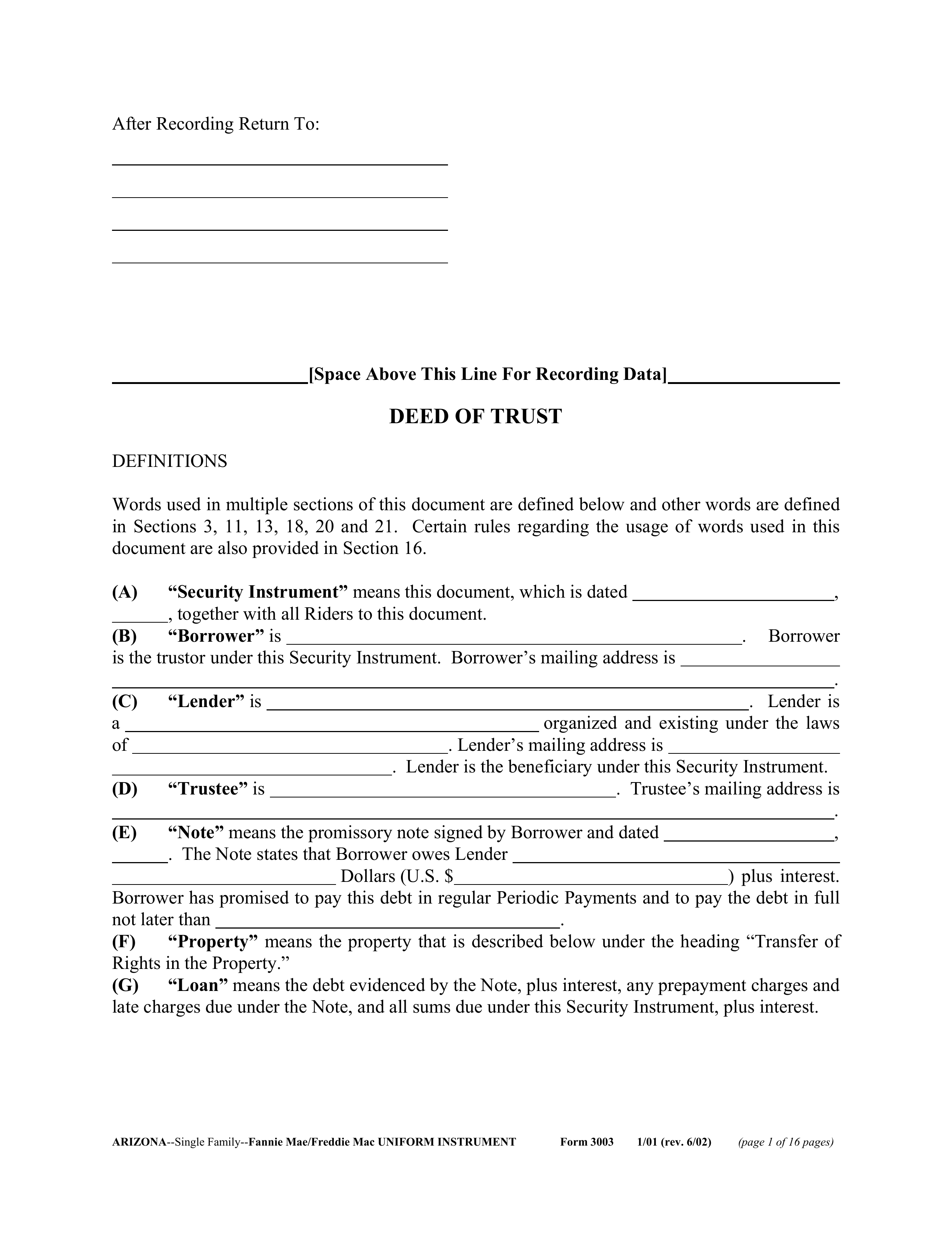

A bargain and sale deed only states that the seller holds title to the property; it does not protect the buyer from liens or debts. This type of deed is most common in tax sales and foreclosures, when the property’s history may be unclear. A property deed serves as a public record of who owns a home or land, so it’s a key document when it comes to legal matters concerning the property. If an ownership dispute arises, for example, you may be able to resolve it by simply confirming the name on the deed. In addition to identifying the property’s current and future owners, a house deed must include certain language permitting the legal transfer of a property to take place.

Recording Requirements

In some states, these may be considered separate deed types, but in California, these are usually just customized grant deeds. Any time owners make a change to the title of real estate, they must record a deed with the County Recorder. This Step-by-Step guide outlines the requirements and provides samples with instructions. Title refers to the broader legal concept of the property rights and responsibilities that come with the ownership of real property. A deed is a physical document that transfers the title from one person to another. It is the document signed by the grantor that transfers the title to the grantee.

Keep reading as Trust & Will explains what you need to know about house deeds used in real estate. For instance, If the property was transferred to you through a general warranty deed, you’d have the highest level of protection. The previous owner provided guarantees that they would be held liable for any title issues that could arise. It would be their responsibility to deal with any legal or financial ramifications for any title issues that stemmed from the time that they owned the house and earlier. In contrast, let’s say that you acquired a property through a bargain and sale deed. In this case, you were provided with no warranties or covenants whatsoever.

Deeds and Consideration

While putting together a deed may be the work of a real estate attorney, this service is also often provided by title companies. Bargain and Sale Deed If your home is being sold in a tax sale or foreclosure, the property may be sold with a Bargain and Sale Deed. This means that the seller doesn’t need to clear title and there are no protections for the buyer. For example, if you’ve got liens on the property, they stay with it when you sell.

In real estate, a lien is the right to seize and sell a property if a contract is not met. A mortgage is an example of a lien that is put in place automatically; the mortgage lender has the right to seize the property if the owner is unable to make their mortgage payments. A lien on a property may prevent it from being sold, or it may pass to the buyer under certain types of deeds.

Deed vs. Title

When there is more than one grantee, you will need to specify the form of title. It can also be helpful to do that if a grantee is a married person or domestic partner. You will find filled-out samples of each type of deed at the end of this guide. If you have questions about which form of title to use, talk to a family or estate lawyer or research your options at the law library. By stipulating consideration, the parties demonstrate their mutual intent to enter into a binding agreement for the transfer of property.

Additionally, assets passed on via a gift deed bypass the probate process, enabling a quicker and more direct transfer to the recipient without court involvement. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Deed transfer costs vary considerably by location since different locales charge transfer taxes at different rates.

A quitclaim deed serves to transfer a property from a grantor to a grantee, with very little protection for the grantee. This type of deed is most often used when transferring property between family members or when an error in the title needs to be fixed. One single owner who owns their house outright will sell their home to another single purchaser. However, there are instances when deeds can get complicated and tricky. There are cases in which the deed could be incorrect, or cases involving multiple owners who have equal claim to a property.

For example, an unrecorded deed may become an issue for heirs once the original owner dies. In some cases, this will take you to the website of your local County Recorder or equivalent. If you’re lucky, your county might even provide a self-service official records search site. From here, you may be able to look up your property, locate the deed, and download a copy of your deed onto the computer. It also discusses related legal issues such as disclosure requirements, community property issues, and tax and estate planning. There are many other types of deeds, such as warranty deed, joint tenancy deed, easement deed, trust deed, etc.

It also includes signatures of both parties and may require witnesses or a notary public to authenticate the signatures. A deed is a binding document in a court of law only after it is filed in the public record by a local government official who is tasked with maintaining documents. This deed gives ownership rights to a buyer at a sheriff’s sale, usually at auction. This typically occurs when the home has been foreclosed on for unpaid property taxes. But the grantor doesn’t make any promises about the condition of the title before they owned the property.